The state of Massachusetts typically taxes nonresident workers on the wages they earn while in the state.

Massachusetts' Convenience of the Employer Rule However, if the other state doesn't apply the Convenience of Employer test, Connecticut doesn't apply it for those who have worked remotely.įor example, if you are a resident of New York and have worked remotely for Connecticut employers, you will qualify under the convenience rule because New York has implemented the rule. The state of Connecticut has adopted a tax policy that requires employees in the state to pass the Convenience of the Employer test only if the employee's residence state applies similar tax laws for work performed for a Connecticut employer. Connecticut's Convenience of the Employer Rule The five states are:Īt the same time, two additional states use a variation of the rule for tax purposes: Massachusetts and Connecticut. Multiple states have adopted this rule that heavily impacts remote employees.

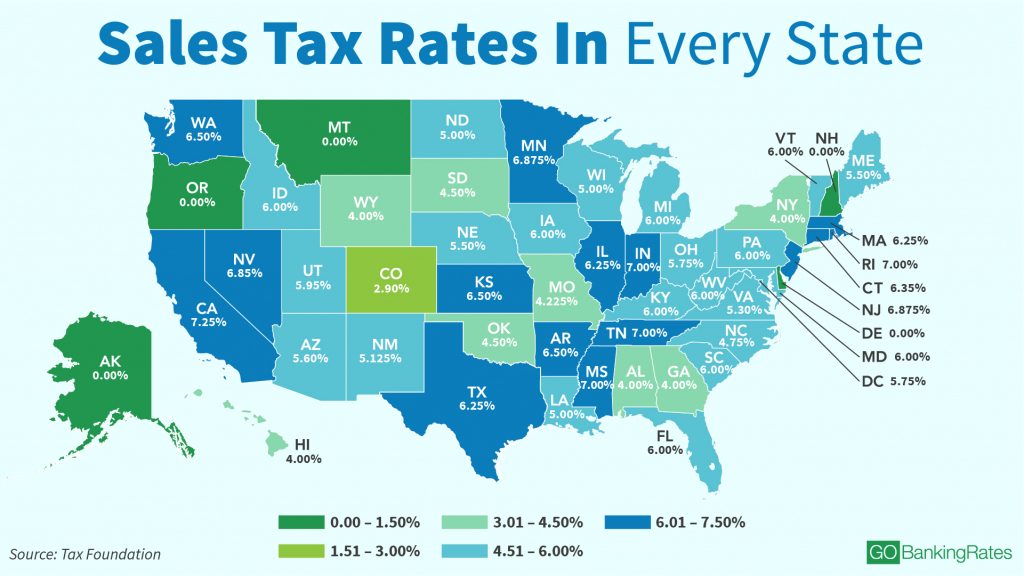

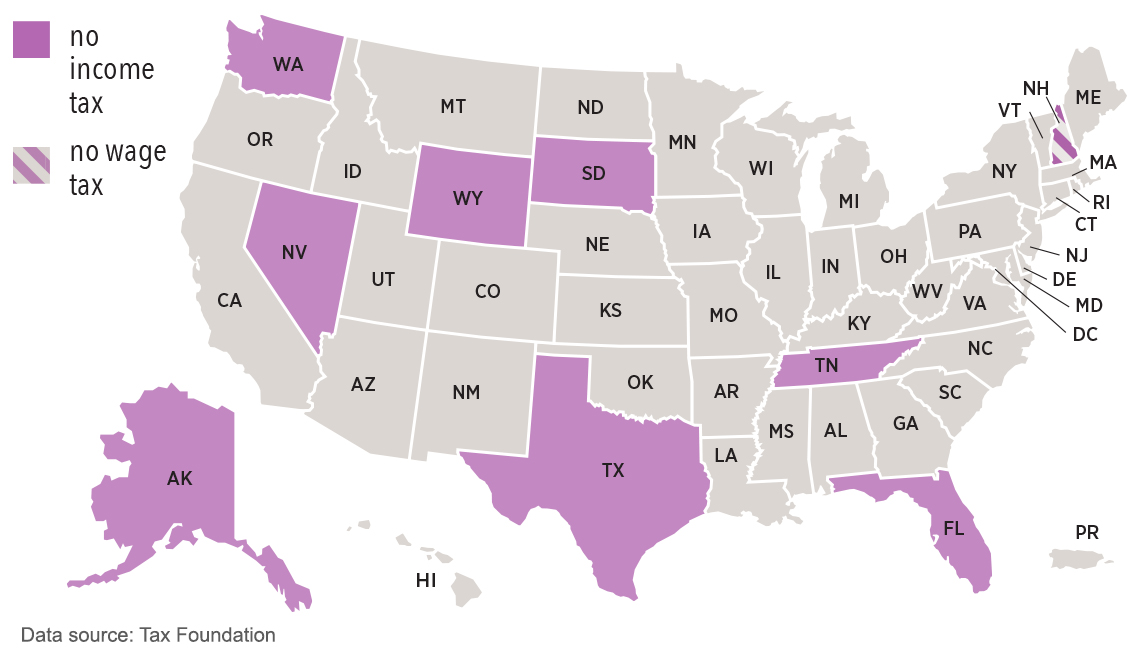

area will pay a maximum individual income tax rate of 8.9%. This tidbit can offer significant advantages to workers who live in a large city and want to migrate to a rural area or another state with lower or no state income taxes.įor instance, someone who works and lives in the Washington D.C.

Remote Workers, Convenience Tax, and Tax LiabilityĪs a general rule of thumb, workers are required to pay state income taxes to the state they reside in. Let's take a deeper dive into the subject surrounding state tax implications of working remotely from another state. Remote workers in New York and the surrounding states may be subject to double state income tax taxation. While the new arrangement offers a number of key benefits - including convenience - these benefits are coming at a tremendous cost. Amid the global pandemic, the face and nature of work quickly evolved from in-office to a work-from-home, remote employment landscape.

0 kommentar(er)

0 kommentar(er)